Blog

A Gift of Love and Vision: (Estate) Planning Your Legacy

Have you ever considered the power your legacy holds? Imagine a world where your love and vision continue to impact lives long after you’re gone. Estate planning, often shrouded in misconceptions of complexity and hefty costs, is far more than a mere legal necessity. It is, at its heart, one of the most profound expressions of care and foresight you can offer your loved ones. By planning your estate, you’re not just allocating assets; you’re ensuring that your values, passions, and the causes closest to your heart are honored and go on after your death.

The Importance of Getting Affairs in Order

In life’s unpredictable journey, the importance of having one’s affairs in order cannot be overstated. Imagine the heartache and confusion that could envelop a family when they are left to navigate the aftermath of a loved one’s passing without any guidance or plan in place. The absence of an estate plan can put loved ones into emotional and financial turmoil, mixing grief with the stress of legal battles and uncertainty about the future.

But estate planning can be a profound gesture of love and consideration. By organizing your estate, you are essentially laying a clear path for your loved ones to follow, sparing them from potential disputes and the burden of guesswork during a period of mourning. It’s about securing peace of mind for yourself and for those you hold dear, knowing that everything is taken care of and that your wishes will be respected and followed.

This isn’t about the distribution of assets but about leaving a legacy that speaks volumes of your thoughtfulness and care. Estate planning allows you to relay your values and wishes clearly, ensuring that your loved ones are supported and your chosen causes are advanced. In essence, getting your affairs in order is the ultimate gift of love and peace you can offer, making an already difficult time a little easier for those you leave behind.

Charitable Giving Through Estate Planning

Incorporating charitable giving into your estate plan can transform your legacy into hope and support for future generations. This act of giving extends beyond the confines of personal benefit, touching lives and uplifting communities in ways that resonate far and wide. For many, the joy derived from charitable giving is a profound experience, offering a sense of fulfillment and connection to a cause greater than oneself.

When you choose to include charities in your estate plan, you’re not only magnifying the impact of your generosity but also potentially benefiting from favorable tax implications. This strategic approach ensures that your legacy lives on, supporting causes you care deeply about while also providing for your loved ones. For instance, bequeathing a portion of your estate to a charitable organization can reduce the estate tax burden, ensuring that more of your assets go towards making a meaningful difference.

The process of including charitable gifts in your estate plan can be straightforward and rewarding. Charitable organizations often have teams ready to assist donors in making informed decisions about their legacy gifts, ensuring that their contributions are used effectively to advance the mission they care about. This partnership between donors and charities exemplifies the power of thoughtful estate planning—amplifying the impact of one’s legacy and fostering a culture of generosity.

Practical Steps and Considerations

Embarking on estate planning can seem daunting, but breaking it down into practical steps can demystify the process and make it accessible. A well-thought-out estate plan ensures that your wishes are honored, your loved ones are taken care of, and your charitable intentions are fulfilled. Here are some actionable steps and considerations to guide you through updating your estate plan with ease and confidence.

- Inventory Your Assets: Begin by compiling a comprehensive list of your assets, including savings, investments, real estate, and personal property. Understanding what you own is the first step in deciding how to distribute your assets effectively.

- Designate Your Beneficiaries: Review and update your beneficiary designations for accounts such as retirement savings, life insurance policies, and annuities. These designations often override instructions in wills, so it’s crucial to keep them current to reflect your wishes.

- Consider Charitable Gifts: Decide which charities you wish to support through your estate. Whether it’s a fixed amount, a percentage of your estate, or specific assets, incorporating charitable giving requires thoughtful planning. Consult with the charities of your choice to understand the most effective ways to structure your gift.

- Draft or Update Your Will: A will is central to your estate plan. It outlines how your assets will be distributed and can designate guardians for minor children. If you’re including charitable donations, specify the organizations and the nature of the gifts in your will.

- Explore Trusts: Trusts can be valuable tools for managing your assets and ensuring they are used as intended. A charitable remainder trust, for example, can provide income for your beneficiaries for a period before the remainder goes to your chosen charity.

- Seek Professional Advice: Estate planning involves complex financial and legal considerations. Consulting with an estate planning attorney and a financial advisor can provide clarity and ensure that your plan aligns with your goals and legal requirements.

- Communicate Your Plans: Discuss your estate plan with your family and any involved parties. Transparency can prevent surprises and ensure that your wishes are understood and respected.

Taking these steps can streamline the process of updating your estate plan, making it an achievable goal rather than an overwhelming task. By approaching estate planning with clarity and intention, you’re not only securing your legacy but also providing a clear path forward for your loved ones and the causes you support.

The Role of the Community Foundation

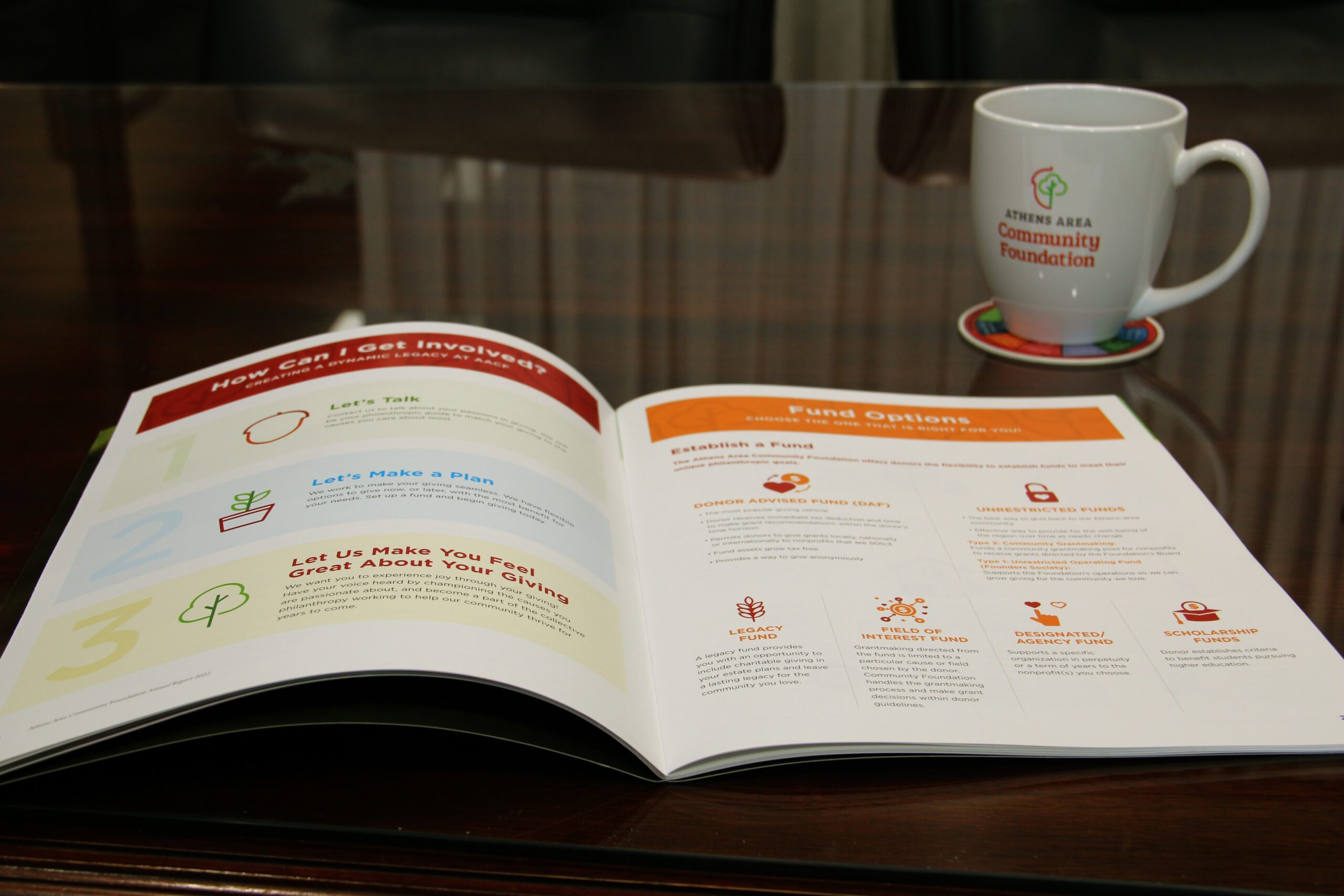

Community Foundations play a pivotal role in translating individual philanthropic aspirations into impactful, lasting legacies. These organizations serve as vital resources for individuals looking to include charitable giving in their estate plans, providing expertise, guidance, and tailored services to meet diverse needs. Understanding the support and services offered by Community Foundations can significantly simplify the process of incorporating charitable giving into your estate plan.

Expertise in Local and Global Causes

The Community Foundations is deeply knowledgeable about local and broader issues, enabling them to direct your philanthropic efforts where they can make the most difference. Whether your passion lies in education, healthcare, the environment, or the arts, these foundations can connect you with causes that align with your values and vision.

Facilitating Charitable Contributions

They offer various services to make the process of giving both efficient and meaningful. This includes providing the legal language for bequests, setting up donor-advised funds, and offering guidance on structuring charitable trusts or annuities. Their expertise ensures that your charitable intentions are executed according to your wishes.

Streamlining the Process

Community Foundations simplify the complexity associated with charitable giving. They handle the administrative and legal aspects, allowing you to focus on the joy of giving. By leveraging their services, you can ensure that your charitable gifts are managed effectively and reach their intended targets.

Building a Legacy

Beyond immediate charitable contributions, Community Foundations assist in building enduring legacies. They work with donors to establish named funds or endowments that continue to support chosen causes for generations. This creates a lasting impact that reflects the donor’s values and philanthropic goals.

Support and Counseling

They provide personal counseling to donors, helping them navigate the emotional and practical aspects of estate planning and charitable giving. This personalized approach ensures that your philanthropic journey is fulfilling and aligned with your overall estate planning objectives.

Secure Your Legacy Today with Your Estate Plan

Your legacy is a reflection of your life’s values, passions, and the mark you wish to leave on the world. By considering your estate plan as a gift of love and vision, you have the power to make a lasting difference. We encourage you to take the first step today: reach out to your advisors and the community foundation to explore how your legacy can support the people and causes you care about most. Together, let’s create a future that benefits from your foresight and generosity.

Return to Blog

Return to Blog